Seth L. Cogswell

Founding Partner and Portfolio Manager

Seth L. Cogswell

Founding Partner and Portfolio Manager

20+ years of industry experience and Running Oak Founder

Seth is the Managing Partner and Founder of Running Oak Capital. He is Co-Portfolio Manager of Efficient Growth. Prior to founding Running Oak, Seth was a trader and portfolio manager of the Trillium Multi Horizon Fund, a multi-strategy long/short hedge fund.

Seth received his MBA from The Wharton School for which he was a recipient of the Goldman Sachs H.R. Young Scholarship. He received his undergraduate degree in Decision Making Sciences/Operations Research from the University of North Carolina.

Jeff Broders, CFA

Chief Operating Officer, Chief Compliance Officer

Jeff Broders, CFA

Chief Operating Officer, Chief Compliance Officer

15+ years of industry experience

Jeff is the Chief Operating Officer and Chief Compliance Officer of Running Oak Capital. Prior to joining Running Oak in September 2021, Jeff was the head of US Product Strategy & Development for Principal Global Investors, a multi-boutique investment management firm.

Jeff is a CFA® charterholder. He received a Master of Financial Management degree from Drake University and his BA degree from the University of Northern Iowa.

Gary F. Cogswell, CFA

Portfolio Manager

Gary F. Cogswell, CFA

Portfolio Manager

40+ years of experience and creator of our core Efficient Growth philosophy

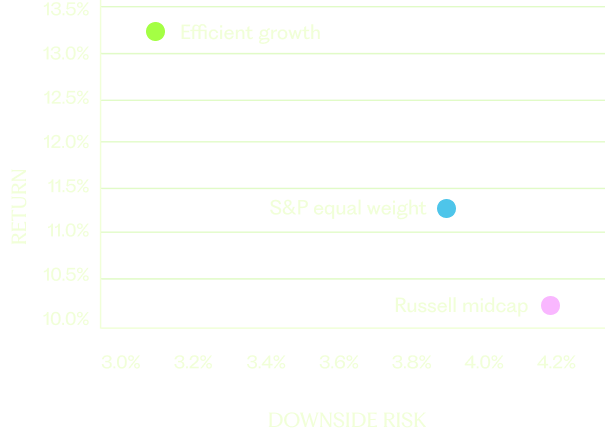

Gary is the primary architect of the Efficient Growth style of equity management, a philosophy he developed in the late 1970s and has been managing ever since. Gary serves as Co-Portfolio Manager of Running Oak’s Efficient Growth Portfolio.

Gary began his career at Wachovia Bank where he was later a Senior Equity Analyst. Following Wachovia, he served as Investment Department Manager and Portfolio Manager for Huntington National Bank. He was later appointed to Director of Research for Boys, Arnold and Company. Gary is a CFA holder, and received both his MBA and BS degrees from Miami University in Oxford, Ohio.

Jena Cogswell

Head of Marketing

Jena Cogswell

Head of Marketing

20 years of industry experience

Prior to joining Running Oak in December 2024, Jena was the Chief Marketing Officer at Bell Bank. Jena began her career at Goldman Sachs Asset Management as a Financial Analyst in New York City. She has also held strategic roles at JP Morgan, Providence Equity Partners and Principal Asset Management. Jena received her BA degree in Communication Studies from the University of North Carolina.